.webp)

Tailored Funding for Your Business

How It Works ? Get a funding offer in 3 easy steps

Apply

Complete our one-page application & provide the last 4 months of business bank statements.

Get A Decision

In as little as 2 hours, we will provide your funding options.

Receive Funding

Receive funds in your account within 24–72 hours.

Why Inventory Financing Is a Smart Way to Fund Growth

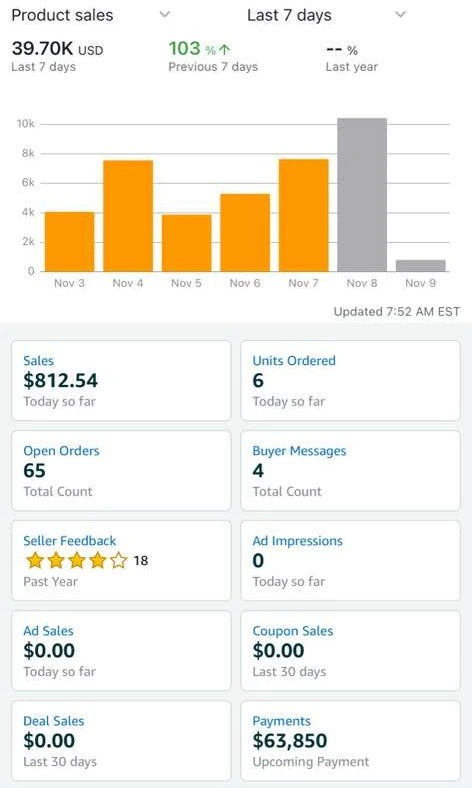

Inventory financing gives eCommerce sellers, Amazon store owners, Walmart marketplace sellers, and Shopify brands the power to grow without draining working capital. By leveraging existing or upcoming inventory as collateral, your business can access fast, flexible loans to buy bulk stock, prepare for seasonal spikes, and avoid costly stockouts. Whether you’re expanding your product catalog, restocking for Q4, or scaling your fulfillment operations, inventory loans help you stay competitive while preserving liquidity. With BusinessFundUSA, you can unlock inventory funding solutions tailored for online retailers and wholesalers—so you can increase sales, improve profit margins, and grow sustainably.

Frequently Asked Questions

We specialize in funding eCommerce sellers operating on Amazon, Walmart, Shopify, and TikTok Shop. Whether you’re a private-label brand, reseller, or DTC storefront, we provide capital designed to help you restock, scale, and grow your operations.

Most approved businesses receive funding within 24–48 hours after completing the application and verification process. The exact timeline depends on your sales volume, marketplace performance, and documentation.

Our working capital programs range from $10,000 up to $10 million. The amount you qualify for depends on your monthly sales, marketplace performance, and business cash flow.

No. Our programs are equity-free and collateral-free. You keep full ownership of your business. Approval is based primarily on your sales performance and revenue consistency, not personal assets.

You can use the capital for inventory restock, marketing and ad campaigns, product launches, hiring, equipment, or any business expense that helps you grow your online store.

Unlike traditional bank loans, our funding options are fast, flexible, and designed for online sellers. We don’t require perfect credit or weeks of paperwork. Our approval process is based on your real business performance, not just your credit score.

No, there’s no hard credit pull when you apply. We do a soft check to evaluate your business health without impacting your credit.

Perfect — we love multi-channel sellers. If you operate on Amazon, Walmart, Shopify, and TikTok Shop, we can consolidate your performance data to maximize your funding amount and flexibility.

Yes. We use bank-level encryption and never share your data with third parties without consent. Your business and financial information stay fully confidential.

Simply click “Apply Now” and complete the short application form. A funding specialist will review your business performance and contact you with customized options — often within the same day.

See how sellers grow with Us

ABF gave us the flexibility to scale our Shopify store without worrying about short-term cash flow. Their funding model helped us grow 750% in just one year.

ABF understands ecommerce inside out. Their support helped us optimize inventory flow and scale operations by 300%. Highly recommended for serious sellers.

Thanks to ABF, we scaled our brand to $6M in revenue without giving up equity. Their tools and funding helped us streamline our supply chain and meet growing demand.